Understanding Customer Lifetime Value (CLV)

Attaining a steady stream of revenue is a key element of a business strategy across all industries. Customers form the lifeblood of every business, irrespective of the industry that it operates in. Consequently, the total value that the business can avail from each of its customers forms an important component of its long–term operations. It is this value that is reflected in the calculation of Customer Lifetime Value (CLV) as a metric.

Customer lifetime value should not be confused with customer profitability, which takes into account the costs and profits associated with a single customer, and is always calculated in hindsight. Customer Lifetime Value is a future-oriented metric that relies on various dynamic components that can change over the course of a business.

Calculating CLV

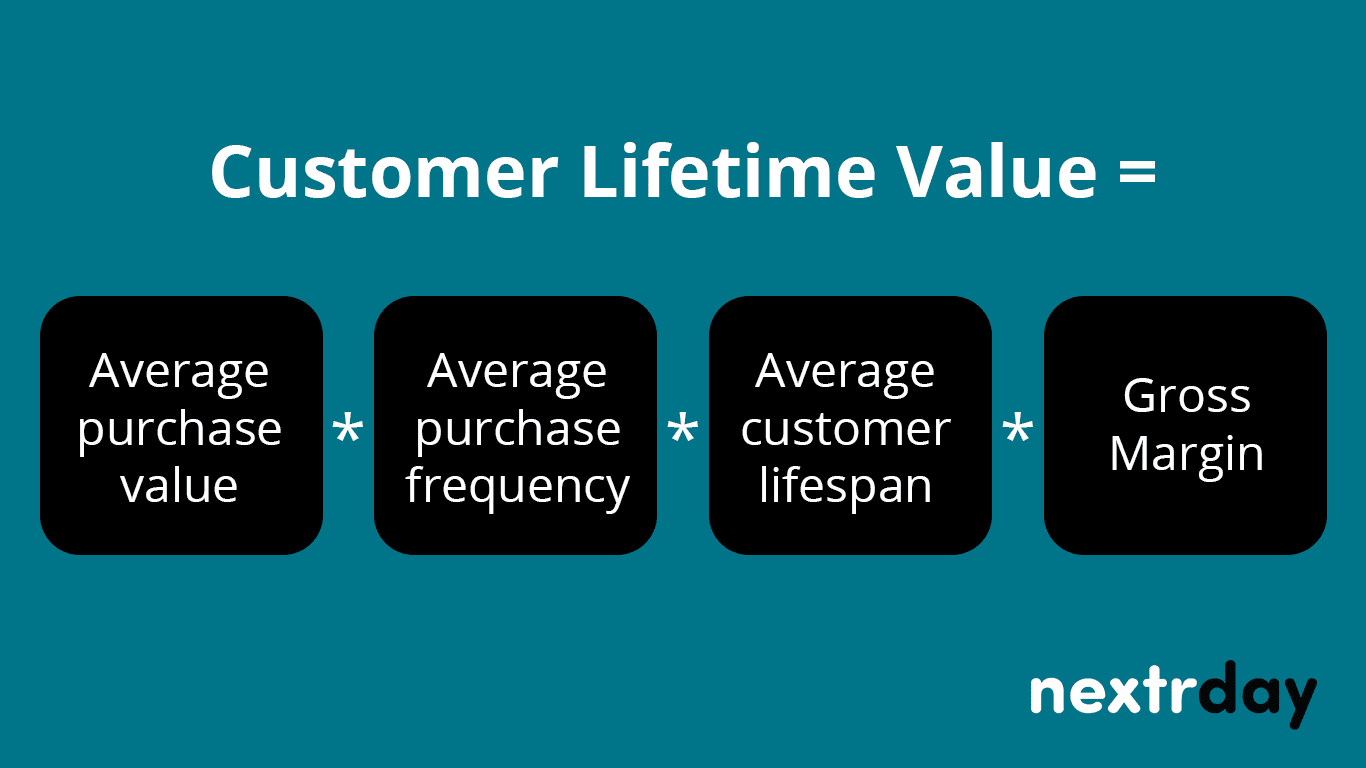

How you calculate your customer lifetime value heavily depends on the stage at which your business is in. Newer businesses will inevitably need to make considerable assumptions on several metrics, whereas mature businesses can benefit from historical data in calculating CLV. However, here’s a definitive formula that works for almost all businesses in light of the metrics that they usually have access to, through their systems:

Here, average purchase value refers to the average value of a single transaction with a customer, average purchase frequency refers to the number of purchases a customer makes over a given period (usually a year). Average customer lifespan refers to how long a customer transacts with the business and gross margin represents the percentage of your revenue that stays after subtracting the cost of goods sold (COGS).

Retention – Decoding the importance of CLV

All businesses operate under limited information and heavy uncertainty. Being able to identify key levers that can be used to drive effective decision-making is an invaluable skill for every business. As a metric, CLV is comprehensive enough to give the business an indication of the value that a customer provides over the course of their entire relationship with the business.

Looking at CLV and nurturing it relentlessly makes all the more sense in light of the following facts:

- Profits increase by 25% when retention increases by 5% [1]

- Existing customers are 70% more likely to convert [2]

- New customers can be 25x more expensive to acquire [2]

It should then come as no surprise that close to 80% of all companies treat CLV as an important concept within their organization [2]. Consistent monitoring of CLV can enable a business to access a wide range of benefits, the likes of which are listed below.

Identifying High-Value Customers

Choosing which customers to target is one of the most crucial decisions a business can make. Marketing budgets are limited and all marketing departments are tasked with attracting prospects who will turn out to be loyal, profitable, and easy to retain. The only real tool to measure the quality of a customer is the CLV as it gives granular insights into how valuable each one is. If the average CLV is low, that might be a cue for the business to adjust its marketing strategy accordingly.

Determining acquisition costs

Customer acquisition costs (CAC) along with CLV prove to be useful in determining how much leeway in business has in acquiring customers. Why? Because if the amount earned from a customer is dwarfed by the amount spent to acquire them, the business will suffer in the long–term.

Consider the example of a magazine subscription business where the cost to acquire a customer is $500 and the average subscription tenure is 5 years. If an annual subscription costs $1,000, then total revenue (as measured over 5 years) is $5,000. The business incurs additional costs to the tune of $50 per customer. In this case, the CLV of the customer is:

CLV = $5,000 – $500 – $50 = $4,450

In this example, the method for calculating CLV differs slightly from the formula mentioned previously. This is because of the nature of the subscription business, where each purchase is a recurring purchase and (in our case) the purchase value remains steady at $1,000. Furthermore, subscription businesses (especially those that operate digitally) generally have fixed costs of production that do not scale linearly with a concurrent rise in customers.

As a result, the original formula is tweaked to fit the business model to arrive at a reasonable estimate of the CLV. However, the fundamentals remain the same – measure revenue for as long as the customer transacts with the business, and subtract the costs associated with attracting and servicing them.

Sowing brand loyalty

Brand loyalty is usually a function of average purchase frequencies and average customer lifespan. When both of these figures go up, a customer is deemed to be loyal. This results in an increase in CLV, which then translates to better business outcomes.

Brand loyalty programs can help the company identify loyal customers and institute initiatives and rewards that can help retain these customers, thereby increasing their CLV in the long run. Building brand loyalty is a cornerstone of architecting delightful customer experiences and driving overall customer engagement.

Measuring Retention

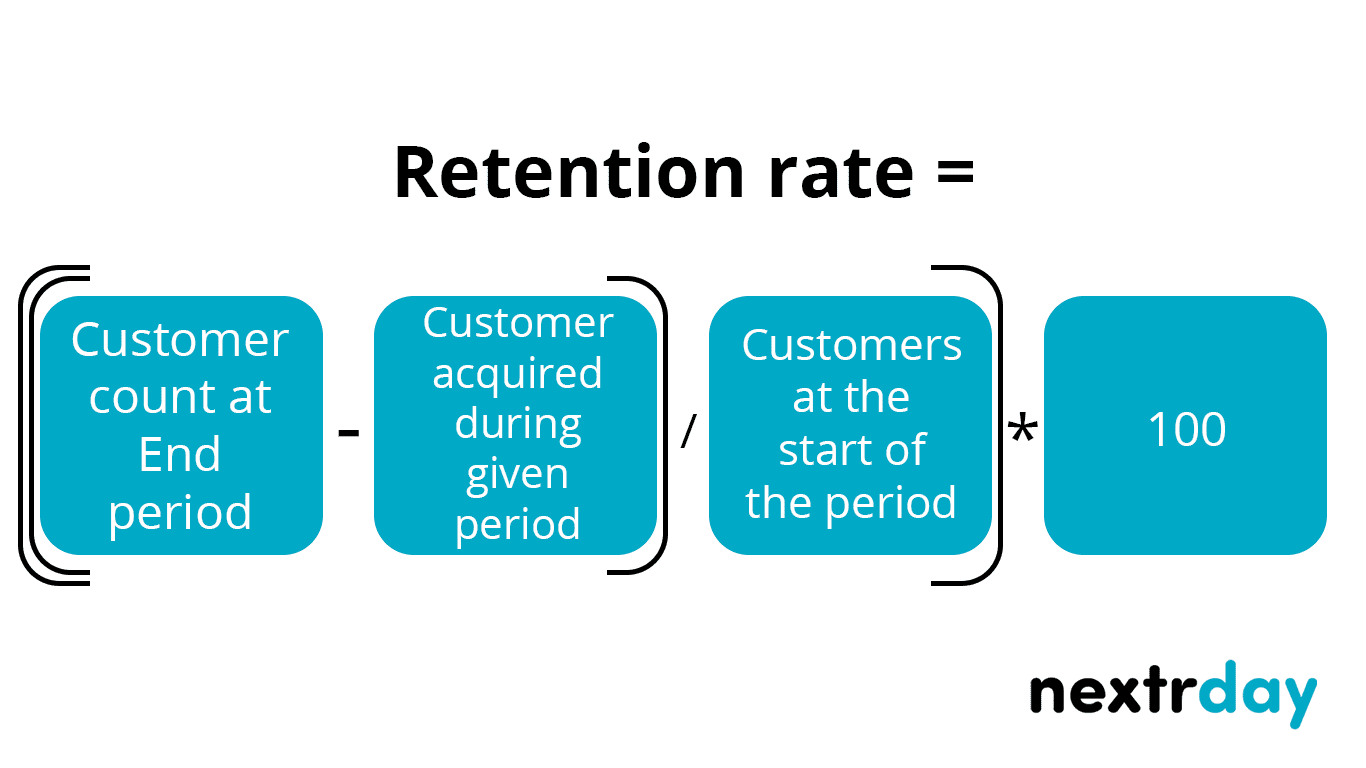

Everything that a CLV enables a business to do, revolves around customer retention. The longer a business can retain its customers, the greater the prospects of it succeeding. Customer retention, colloquially referred to as the churn rate is calculated using the following formula:

The higher the retention rate, the better it is for the business. As a general rule of thumb, businesses usually aim to have a retention rate of 85%.

What’s next?

In days past, before the advent of computers, customer lifetime value was largely regarded as an unquantifiable metric that was near impossible to measure because of the high costs associated with collecting, cleaning, and arranging the requisite data. Today, with precise and highly advanced measurement tools, instituting a data collection framework is easier than it has ever been.

All companies, especially those that have small-ticket purchases and rely heavily on non-governmental contracts will notice a sharp increase in their bottom line when they institute a sharp focus on CLV and CAC. Together, these metrics inform the overall health of the business and are crucial in determining how well a certain set of strategic decisions are panning out. In the age of hypergrowth and blind ‘growth at all costs strategies., those that make calculated moves with the aim of achieving stable increases in long-term CLV will go on to build resilient, sustainable businesses that will create long-lasting value for both their shareholders and their customers.

We love helping ambitious organizations reach new levels of sustainable growth through vision and purpose, strategy and execution, digital tools and go-to-market optimization.